Ready to File Your BOI Report?

In September of 2022, the Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the bipartisan Corporate Transparency Act’s (CTA) beneficial ownership information (BOI) report. The rule will enhance the ability of government agencies to protect national security and financial systems from illicit use and help prevent drug traffickers, fraudsters, and other criminals from laundering or hiding money in the United States.

The new rule describes who must file a BOI report, what information must be reported, and when a report is due. Specifically, the rule requires Corporations and Limited Liability Companies to file reports that identify the beneficial owners of the entity and the company applicants of the entity.

Key BOI reporting dates to be aware of:

- FinCEN will begin accepting BOI reports on January 1, 2024

- New businesses that are formed on or after January 1, 2024, must file within 90 days of business formation

- Existing businesses that were formed before January 1, 2024, must file before January 1, 2025

Who Needs to File a BOI Report?

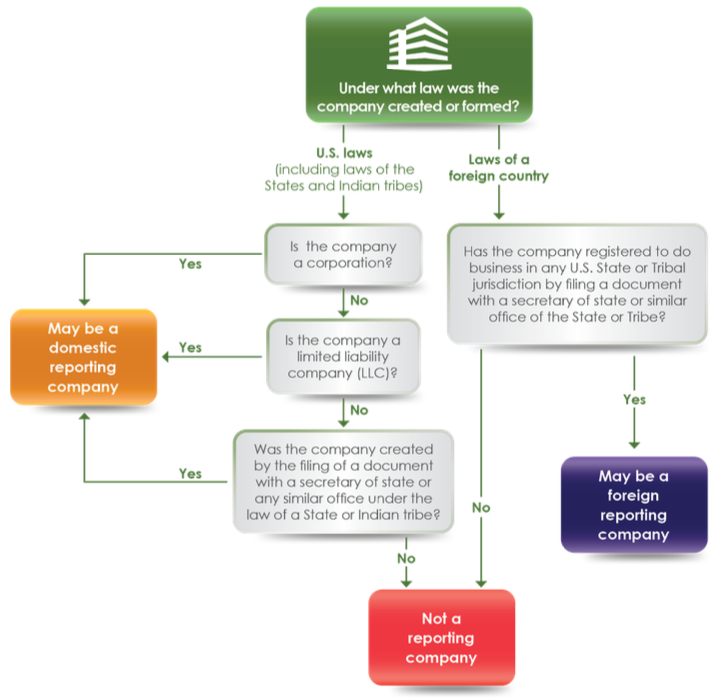

NewThe rule identifies domestic and foreign as the two types of reporting companies that must file a report.

- A domestic reporting company is a Corporation, Limited Liability Company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

- A foreign reporting company is a Corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Under the rule, and in keeping with the CTA, twenty-three types of entities are exempt from the definition of “reporting company.”

FinCEN expects that these definitions will also include Limited Liability Partnerships, Limited Liability Limited Partnerships, Business Trusts, and most limited Partnerships, because such entities are generally created by a filing with a secretary of state or similar office.

Beneficial Owner Information Report FAQs

What is a beneficial ownership information report?

A beneficial ownership information (BOI) report provides the Financial Crimes Enforcement Network (FinCEN) with information about registered business entities, their beneficial owners (individuals with substantial control over or 25% or more ownership interest), and their company applicants.

How is the beneficial ownership information report connected to the Corporate Transparency Act?

BOI reporting is part of the responsibilities set forth by the Corporate Transparency Act (CTA), enacted in 2021, to establish uniform reporting requirements for business entities. By disclosing personal details about who owns or controls a company, the beneficial ownership report is meant to help identify and prevent illegal activity — such as tax fraud, money laundering, drug trafficking, and financing of terrorism.

Is every company required to file a BOI report?

Most registered business entities meet FinCEN’s definition of a “reporting company.” Reporting companies can be either domestic or foreign.

- Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or with any similar office under the law of a state or Indian tribe.

- Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.

So, LLCs, C Corporations, S Corporations, and other types of corporations fit the definition. FinCEN doesn’t specifically mention them, but different entity types — such as Limited Partnerships, Limited Liability Partnerships, Limited Liability Limited Partnerships, and Business Trusts — might also be reporting companies.

Businesses, like Sole Proprietorships and General Partnerships, which do not register formation documents, do not have to file a beneficial ownership report.

Who is exempt from the reporting rule?

FinCEN has identified 23 exemption categories. If an entity is in one of those categories and meets its specific exemption criteria, it does not have to submit a beneficial ownership report. The exemptions are primarily for entities already under close regulation by the federal and state governments.

- Securities reporting issuer

- Governmental authority

- Banks

- Credit unions

- Depository institutions holding company

- Money services business

- Broker or dealer in securities

- Securities exchange or clearing agencies

- Other Exchange Act registered entites

- Investment companies or investment advisers

- Venture capital fund advisers

- Insurance companies

- State-licensed insurance producers

- Commodity Exchange Act registered entities

- Public utilities

- Financial market utilities

- Pooled investment vehicles

- Tax-exempt entities

- Entity assisting a tax-exempt entities

- Large operating companies

- Subsidiary of certain exempt entities

- Inactive entities

- Public accounting firms registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002 (15 U.S.C. 7212)

Simply falling into any of these categories does not automatically make a reporting company exempt. Each category has specific criteria that must be met to qualify for exemption. Refer to FinCEN’s Small Entity Compliance Guide for details.

When are beneficial ownership reports due?

FinCEN will begin accepting BOI reports on January 1, 2024. Deadlines depend on when a reporting company was created or registered.

- Reporting companies created or registered to do business before January 1, 2024 – Initial BOI report is due by January 1, 2025.

- Reporting companies created or registered on or after January 1, 2024 and before January 1, 2025 – Initial BOI report is due within 90 days of the entity’s formation.

- Reporting companies created or registered on or after January 1, 2025 – Initial BOI report is due within 30 days of the entity’s formation.

Who is a beneficial owner of a reporting company?

A reporting company’s beneficial owner is any individual who owns or controls 25% or more of the ownership interests of a reporting company or who directly or indirectly exercises substantial control over the entity.

Some types of individuals do not count as beneficial owners:

- An employee (not in a senior position) whose control or economic benefits from the reporting company are derived solely from their activities as an employee.

- An individual who has only a future ownership interest through a right of inheritance (once they inherit the interest, they must be reported)

- A custodian, nominee, intermediary, or agent of another individual who meets the beneficial owner definition

- A minor child (information about a parent or guardian must be reported instead)

- Creditors of the reporting company

What is considered an ownership interest?

Any individual who owns or controls at least 25% of the ownership interests in a reporting company is considered a beneficial owner.

An ownership interest may be any of the following:

- Equity

- Stock

- Capital or profit interest

- Voting rights

- Any instrument convertible into stock, equity, voting rights, or capital or profit interest

- Options or other non-binding privileges to buy or sell any of the interests mentioned above

- Any other contract, instrument, or mechanism to establish ownership

What does “substantial control” over a reporting company mean?

An individual has substantial control if they: 1) Are a senior officer (e.g., CEO, CFO, COO, or other executive level position with a high degree of authority); 2) Have the authority to appoint and remove senior officers and members of the board of directors or other governing body; or 3) Make, direct, or influence the company’s important decisions.

Important decisions could include those concerning things like reorganizations, mergers and acquisitions, making amendments to the company’s governance documents, adding or removing lines of business, expanding into different markets, determining senior officers’ compensation structures, dissolving the business, entering into contracts, and selling or leasing principal assets, etc.

What are some examples of substantial control?

Substantial control might be direct or indirect.

Examples of direct substantial control include:

- Serving on the reporting company’s board of directors

- Owning or controlling a majority of voting power or voting rights

- Having rights associated with financing or interest

Examples of indirect substantial control include:

- Controlling any intermediary entities that exercise substantial control over a reporting company

- Having financial or business relationships with other entities or individuals acting as nominees

Is there a limit to how many beneficial owners we have to report?

Reporting companies must identify ALL individuals who meet the definition of a beneficial owner and do not qualify as an exception to the reporting rule.

Who is a company applicant?

A company applicant is a person who physically or electronically files a business registration application with the state to form an LLC, Corporation, or other legal entity or who files an application to register a non-U.S. to conduct business in the United States.

If more than one individual is involved in the reporting company’s formation filing process, both the person who directly filed the formation document and the individual who helped direct or control the filing must be included in the BOI report.

Does every reporting company have to identify a company applicant?

No. Only domestic reporting companies created on or after January 1, 2024 and foreign reporting companies first registered to do business in the U.S. on or after January 1, 2024 must include their company applicants in their BOI report.

What details must we include about our company and its beneficial owners and company applicants?

Reporting companies must include the following information about their business entity:

- Legal name

- DBAs or trade names

- A principal business address in the U.S.

- Formation or registration jurisdiction (state, tribal, or foreign)

- Federal taxpayer ID number (TIN, Social Security Number, EIN)

The information they must provide about their beneficial owners and company applicants include:

- The individual’s full legal name

- Date of birth

- Residential street address (Company applicants may use the business address in some instances).

- Personal identification number and issuing jurisdiction from a non-expired U.S. passport, state driver’s license, or other ID document issued by a state, local government, or tribe — also an image of the ID document. (Individuals may use a foreign passport if they don’t have any other forms of ID.)

To streamline the report filing process, reporting companies, beneficial owners, and company applicants can obtain a FinCEN identifier, which eliminates the need to enter some of the specific details within the BOI report.

What is a FinCEN ID number?

A FinCEN identifier is a unique number assigned upon request to a reporting company, beneficial owner, or company applicant. Reporting companies can use FinCEN identifiers to simplify and streamline completing their BOI forms. No one is required to obtain a FinCEN identifier.

A reporting company can request one by checking the designated box on its BOI report. Individuals may request a FinCEN identifier through an electronic application.

How do I report my company’s beneficial ownership information?

You’ll file your BOI report through FinCEN’s secure filing system, which will be available starting January 1, 2024. From that date forward, you can find instructions and technical guidance in the BOI section of the FinCEN website.

Do I have to file a BOI report every year?

No. However, if information about your reporting company or its beneficial owners has changed, you may have to issue an updated report.

What if any information on our BOI report has changed or we made a mistake?

FinCEN requires reporting companies to file an updated report within 30 calendar days of when a relevant change occurs or when they realize they provided inaccurate information in their BOI report.

Are there penalties for not reporting beneficial ownership information?

Indeed, there are! There could be civil penalties of up to $500 per day for each day a BOI report is late. Willful failure or attempt to provide false or fraudulent beneficial ownership information could bring criminal penalties, including imprisonment for up to two years and/or a fine of up to $10,000.

What happens if an exempt company files a BOI report? Is there a downside?

Other than being unnecessary and reducing privacy, there is no real downside.

How will FinCEN use my information? Do they share it with anyone else?

FinCEN will keep all the information it collects in a secure database. The information will not be publicly available. Federal, state, local, tribal, and foreign government officials may request to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement. If the reporting company consents, financial institutions may have access to beneficial ownership information under certain circumstances.

How can I get help with our BOI report?

Ultimately, reporting companies are responsible for filing their beneficial ownership information report and certifying the information is complete and correct. Any individual who files the BOI report as an agent of the reporting company certifies it on the entity’s behalf.

If you need help determining whether you must file a BOI report or identifying who must be reported as beneficial owners or company applicants, consider getting guidance from an accountant or attorney.

And if you don’t feel confident preparing and filing the report on your own, CorpNet & XBS Marketing is here to act as your agent and file the report on your company’s behalf.